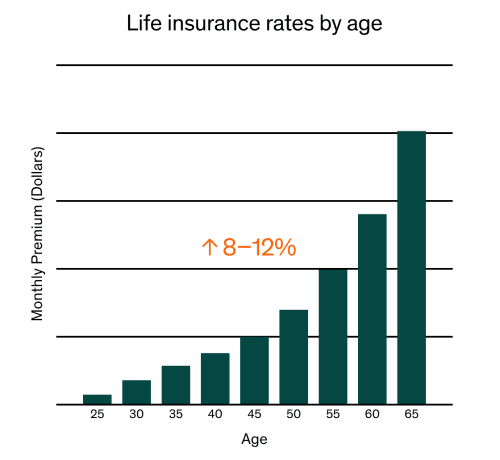

Purchasing life insurance early typically sets you up for your best term insurance rates. The average life insurance cost can increase by 8%, on average, for each year you delay. However, the moment you sign your policy, your rate is locked in and won't change during the policy's term.

For example, a 40-year-old non-smoking male in good health could get a new, 20-year term policy with $1 million coverage for $2,172 a year.* However, if he were to purchase the same policy at age 41, his cost would rise to $2,340 a year—and he'd spend $2,508 annually if he waited another year.

Just look at any term life insurance rates by age chart and you’ll see that your cost increases over time:

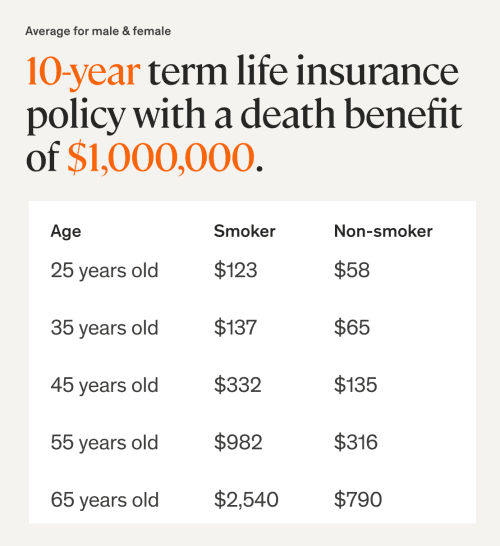

As you age, your average term life insurance costs increase. Based on our policies, we developed a term life insurance rates chart that shows the shift in premiums based on different age groups. The term life insurance cost quotes shown represent a 10-year term life insurance policy with a death benefit of $1 million for applicants in good health.

In this scenario, the monthly term life insurance cost for a 35-year-old non-smoker would be $65. A 45-year-old non-smoker would pay a $135 monthly premium for the same policy.* By purchasing this policy at age 35 instead of 45, you could save $840 per year over the life of your policy.

If you wait until later in life, you should understand that term life insurance rates for seniors are significantly higher. Still, term life insurance rates tend to be more affordable than permanent life insurance for seniors because it provides coverage for a specified period, and it doesn't include a cash value component.

Life insurance tends to be less expensive for younger individuals due to several key factors. First, younger individuals are generally healthier and have a lower risk profile. Since insurance companies assess risk when determining premiums, the lower risks for younger individuals translates to lower term life insurance rates.

While you might think this is a form of age discrimination, it’s really more a matter of statistics. Insurance companies use actuarial tables and statistical models to estimate the likelihood of policyholders passing away during a specific period. These tables consistently show that mortality rates are lower for younger age groups, which is why they offer lower premiums for this demographic.

Many people are waiting until later in life to start families. If you’re one of them and you delay buying life insurance until you have children, it could cost you the opportunity of locking in a low premium. Even if you don’t yet have children to protect, life insurance can cover your personal debts, medical bills, home mortgage, lost wages, and even funeral expenses. This can help take the financial burden off of your partner or another next of kin – and later on, your future children.

Your health status is one of the most crucial factors when determining term life insurance rates. The healthier you are, the less you pay, so getting life insurance at a younger age can be advantageous. As you age, the risk of developing health issues (such as cancer or diabetes) increase, and can lead to higher premiums and sometimes even make it difficult to get coverage. Securing life insurance earlier in life helps protect you—and those who depend on you—against any unexpected changes in your health.

Employer-provided life insurance is a nice benefit, but these policies rarely offer sufficient coverage. Employer-sponsored policies typically only provide coverage of one to two times your annual salary. However, financial experts recommend you carry coverage about 10 times your salary.

The other complication is that if there is any change to your employment status (such as retirement, layoff, or job change), it likely means you’ll lose the policy. If this job status change occurs when you're older—or after you've developed a health issue—it could be more expensive and difficult to secure new coverage. Having your own policy helps protect you and your loved ones against life’s unexpected changes.

You’ve seen that life insurance rates by age can be dramatically different as you get older. Though your age is not something you can alter, there are some other factors that can help you lower your term life insurance cost.

Maintain good health: Your health is a significant factor in determining life insurance rates. Individuals in good health typically qualify for lower premiums. If you have any existing health issues, work on improving them before applying for coverage.

Choose the right coverage amount and term length: Choosing a coverage amount that accurately reflects your needs and opting for a suitable term length can help you avoid overpaying for unnecessary coverage.

Quit smoking: Smoking is a major risk factor for insurance companies, and smokers generally pay higher premiums. If you quit smoking, you may be eligible for lower rates after a certain period of being smoke-free.

/Stocksy_txp2f9ae4e7Z2j200_Large_2319519_qn4jj4.jpg)